Elizabeth Warren’s Rise Started by Looking at the Bottom

As a young scholar, Elizabeth Warren traveled to federal courthouses, studying families overwhelmed by debt. She brought along a photocopier, gathering reams of statistics as she tried to answer one question: Why were these folks going bankrupt?

Warren, then a law professor, wasn't satisfied with textbook explanations; she wanted to hear directly from people drowning in debt. So she sat in courtrooms, listening to one hard-luck story after another. She interviewed lawyers and judges, duplicated bankruptcy filings on a sturdy copier _ nicknamed R2-D2 _ that she hauled around to save printing costs. And she was joined in her research by two professor-colleagues who teamed with her to study those documents and build a database.

Warren had suspected bankruptcy court might be a last stop for deadbeats, or maybe the very poor. Instead, she discovered mostly middle-class people, many of them homeowners with college degrees who'd suffered one bad break – an illness, a divorce, a job loss. It was the kind of cruel twist that seemed all too familiar: When Warren was 12 years old, her father, a carpet salesman, had a heart attack. The family's station wagon was repossessed, and her mother went to work in a minimum-wage job at Sears to pay the bills.

Warren's foray into bankruptcy was the first step in a four-decade journey that has come to define her public profile and shape her worldview. As a law professor, bankruptcy expert, consumer watchdog, Massachusetts senator and Democratic presidential candidate, Warren has consistently championed economic reforms – with mixed results – to boost the middle class.

"The American middle class was in a lot more trouble than anyone had previously thought," she told The Associated Press, describing her research, "and year by year, the stories have gotten worse. … The game has become a little more tilted and a little more tilted against hardworking families."

Warren has carved out a niche as a merciless critic of credit card companies, big banks, lobbyists and Wall Street financiers, blaming them for policies and practices she has labeled as predatory, greedy or corrupt. At the same time, she cites her bankruptcy studies for revealing the real damage caused by these economic forces. It ultimately led to her prescient warnings about the economic collapse of 2008. And she continues to point to her focus on the middle class as she warns of another on the horizon.

"I've spent most of my career getting to the bottom of what's happening to working families in America," Warren recently wrote in a post titled "The Coming Economic Crash and How to Stop It."

Childhood challenges

Warren's own childhood was steeped in financial insecurity. She often describes her Oklahoma upbringing as "the ragged edge of the middle class." After her father recovered, he found work as a janitor. But there wasn't money for college until Elizabeth Herring – the youngest of four and the only girl – parlayed her champion debating skills into a full scholarship.

She married at 19, became a mother at 22, divorced and remarried. After a brief stint as a speech therapist, she changed careers, attended Rutgers Law School and eventually landed a job at the University of Texas at Austin School of Law.

She asked to teach bankruptcy, she recalled in "A Fighting Chance," her memoir, because she wanted to know what led people to "the edge of disaster," but thought the question seemed too personal to ask openly.

Bankruptcy law can seem dense and dry, but Warren saw pain, guilt and hope among those filing into bankruptcy court. The prospect of second chances appealed to her, as she later explained to one of her students at Harvard Law School. U.S. Rep. Joe Kennedy III, a Massachusetts Democrat, recalls sitting in her office one day asking her to explain some nuance of the bankruptcy code.

"I turned to her at one point and said, `You know, you could have taught anything. Why on God's green earth did you possibly pick bankruptcy?' " recalls Kennedy, who has endorsed Warren's candidacy. "And I still remember the answer. She said because it's about the way in which people can get to pick themselves up and we help them start again after they fall."

It wasn't just the topic but how Warren and her colleagues pursued their research that set them apart.

Their work began in the early 1980s, when legal scholars tended to focus on businesses and academic papers. But Warren joined two university colleagues in Austin – Jay Westbrook, a law professor and bankruptcy expert, and Teresa Sullivan, a sociologist – for an on-the-ground study. They visited bankruptcy courts in Illinois, Pennsylvania and Texas.

In research that continued over the decade, the three read through more than 1,500 bankruptcy filings, interviewed hundreds facing financial ruin and analyzed the findings from the database.

At the time, the bankruptcy rate was doubling and some experts thought debtors were reckless spenders; one study found almost a third of the people in bankruptcy could have repaid a significant part of their debts. Warren was skeptical, too.

"I knew that my family had been through a lot of tough times, but nobody had actually declared bankruptcy," she recalled in the interview.

But those suspicions were dismissed after she and her colleagues discovered many debtors' lives had been upended by things beyond their control. She saw that in questionnaires in which debtors explained why they'd filed for bankruptcy.

In her memoir, Warren recalls one unforgettable response: "Wife died of cancer. Left $65,000 in medical bills after insurance … worked five part-time jobs to meet rent, utilities, phone, food and insurance."

Some of Warren's friends from her Texas days speculate her political allegiances shifted because she saw her own family in these struggles. Before her Harvard years, she was registered as an independent, then a Republican and finally a Democrat in 1996.

Westbrook says he and Warren didn't talk much about politics during their research, but he assumed she was a moderate Republican who turned more progressive, rejecting a creditor-friendly view that debtors were largely responsible for their predicament. The more they learned, he says, the more they identified with those coming to court.

"They were sort of the middle-class people that could have been our parents or the people next door," he says.

Warren and her Texas colleagues summed up their findings in a book, "As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America."

Arrival in Washington

Warren's credentials as a bankruptcy expert brought her to Washington. In 1995, she was appointed by a former Oklahoma congressman – he and Warren were high school debating acquaintances – to the National Bankruptcy Review Commission.

Two years later, the panel proposed a series of recommendations to Congress, including strengthening the ability to collect child support from those who've filed for bankruptcy and standardizing how much property could be kept by a bankrupt family and under what conditions.

Warren's focus remained on families caught in an economic squeeze. In 2003, she joined her daughter, Amelia Warren Tyagi, to write "The Two-Income Trap: Why Middle-Class Parents Are (Still) Going Broke." One conclusion: "Having a child now is the single best predictor that a woman will end up in financial disaster."

That book thrust Warren into the TV spotlight – both mother and daughter appeared on "Dr. Phil"- but growing scrutiny of her research brought out the critics, too.

In 2005, Warren was part of a team that published a study that had surveyed nearly 1,800 people who'd filed for bankruptcy in five federal courts and found nearly half cited medical causes.

But a group of researchers that analyzed that data concluded medical bills contributed to just 17% of personal bankruptcies and said those affected tended to be closer to poverty rather than the middle class.

In a rebuttal, Warren's team said their critics had ignored large parts of the debtors' own reports of their financial troubles and unfairly portrayed them as deadbeats.

Craig Garthwaite, a health economist at the Kellogg School of Management at Northwestern, is among those who disagree with Warren's conclusions about medical bankruptcy.

"If you ask any economist – pick one at random, show them the study – the statistical methods are not sound," he says. “I don't think that Sen. Warren has the tools to correctly write that study from her training … for the same reason I don't write law articles.''

Garthwaite says the findings exaggerate the degree to which medical bills are responsible for bankruptcy. "Are you getting at the causal role of medical debt in bankruptcy or simply the presence of medical debt of those who go bankrupt? These are hard questions to answer. … Just because a number is big doesn't make it right.''

He also says the Warren team's results have been used as talking points by progressive policymakers to argue for increased government regulation of the health care sector, “Obamacare'' and “Medicare for All.''

Warren cited her research to bolster her fight against bankruptcy legislation – first pushed in the late 1990s by banks and credit card companies – that would make it harder for people to erase their debts. Proponents argued this was a necessary step because too many people who could afford to repay their debts were filing for bankruptcy.

At odds with Biden

In 2002, Warren wrote a New York Times op-ed that maintained the legislation would be particularly devastating to women, who far outnumbered men when filing for bankruptcy. She called out then-Sen. Joe Biden, who supported the measure, noting many banks and credit card companies were incorporated in his home state of Delaware.

Warren remained a fierce opponent for seven years, maintaining that the legislation would impose new pressures on people who weren't irresponsible, just unlucky. In a 2005 Senate Judiciary Committee hearing that has since gone viral, Warren clashed with Biden in sometimes-tense exchanges over bankruptcy courts, credit card companies and interest rates.

At one point, Biden called Warren's argument “mildly demagogic'' and said her problem was not with the bankruptcy bill but with credit card company usury rates. Warren replied: “If you're not going to fix that problem, you can't take away the last shred of protection from these families.''

To which Biden responded: “I got it. OK. You're very good, professor.''

Warren likened the bill's passage to losing a David vs. Goliath battle. "David really did get the slingshot shoved down his throat sideways," she wrote in her memoir. "It hurt then, and it still hurts now."

And it was not to be forgotten. When Biden announced his presidential bid in April, Warren immediately reminded the public they were opponents in the bankruptcy wars, declaring the former vice president had chosen credit card companies over "millions of hardworking families."

Warren's willingness to challenge Biden or other Democrats doesn't surprise friends or former colleagues.

Lynn LoPucki, a professor at the UCLA School of Law who has co-written several legal texts with Warren, says the senator has long been outspoken and blunt.

"She doesn't have a public persona and then say something different in private,'' he says.

Warren is also known for her folksy manner – uttering an occasional “golly gee'' or “holy cow'' – and her skill at translating arcane financial terms into everyday language.

"She's really effective in communicating with the public, which most academics are not,'' says Michael Barr, dean of the Gerald Ford School of Public Policy at the University of Michigan who met Warren when he was a top Treasury Department official in the Obama administration. “I think she has a real way of connecting with ordinary families.''

Warren was equally adept at educating senators and staff on Capitol Hill, says Melissa Jacoby, a professor at the University of North Carolina School of Law who was an attorney on the 1995 bankruptcy commission.

"Elizabeth can take a very complicated set of rules that most people think has nothing to do with their lives and in a small amount of time explain why they should care very deeply about it,'' Jacoby says. “She's always been really good at … telling important stories and bringing out important themes, but also having the head for all the underlying data.''

Warren moved from bankruptcy into consumer advocacy shortly after the 2008 election as the nation's financial system was on the brink of collapse. Then-Senate Majority Leader Harry Reid tapped her to be on a congressional oversight panel to monitor the $700 billion bank bailout package.

Warren used her new platform to lobby for a program she'd first proposed years earlier that seemed particularly timely: the creation of the Consumer Financial Protection Bureau, a watchdog agency that would better regulate mortgages, student loans, credit cards and other financial products.

After much political wrangling, the bureau was created under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Though President Barack Obama asked Warren to set up the agency, Republican opposition prevented her from getting the director's job.

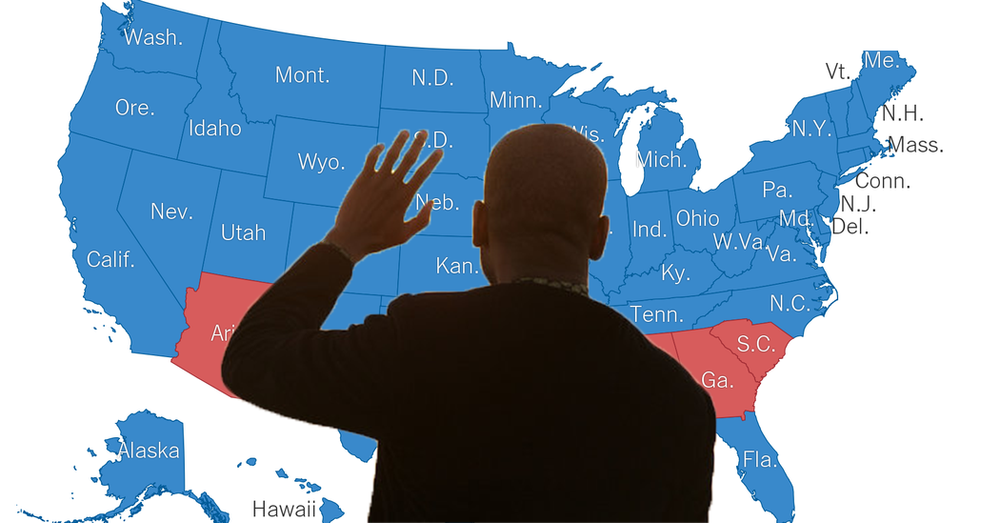

But Warren was back in Washington a few years later – as a U.S. senator. At age 63, she won her first race for public office, ousting Republican Sen. Scott Brown.

Now as a presidential candidate, Warren is on the campaign trail with a long list of policy proposals and a call for structural changes in the government.

In her memoir, she lamented her frustration a decade earlier chairing the bailout panel that “couldn't change a system that seemed hell-bent on protecting the big guys and leaving everyone else on the side of the road.''

But she also said that experience taught her an important lesson:

"When you have no real power, go public, really public. The public is where the real power is."

Former Illinois Congressman Challenges Trump for Republican Presidential NominationNext PostBook Tries to Show how US Democracy Hurt Native Americans

Former Illinois Congressman Challenges Trump for Republican Presidential NominationNext PostBook Tries to Show how US Democracy Hurt Native Americans